The Unreasonable Ecological Cost of #CryptoArt (Part 1)

Update — Sep 2022

As of 15th September, after many years of delays, Ethereum Mainnet has finally switched to Proof-of-Stake in an event known as The Merge. This uses a completely different algorithm to the one discussed below (Proof-of-Work). As a result, moving forward, the numbers below are no longer relevant, and current Ethereum energy consumption is thought to be reduced by ~99.95%.

Update — Dec 2021

There is now more research on the emissions of

1. The Ethereum network as a whole,

2. NFT platforms on the Ethereum network, and

3. Per-Transaction footprint / responsibility allocation.

conducted by Kyle McDonald.

The above resources currently contain the most up-to-date figures.

Kyle has used a completely different approach (bottom-up) compared to the method my calculations are based on (top-down, as used by digiconomist). Kyle also uses a Fee-based accounting model as opposed to the Gas-based accounting model that I use (note that Gas and Fee are highly correlated, and at times NFT-related tx fees are disproportionately higher than the Gas that they use, see links #2 and #3 above). Despite these differences in methodology, the carbon footprint of an NFT comes out very similar with both approaches. Using Kyle’s calculations yields an average carbon footprint for a single-edition NFT averaged across all NFT platforms on Ethereum (rounded to closest 100Kg) as:

100 KgCO2 to mint (1–2 hour flight, e.g. London-Frankfurt)

200+ KgCO2 for a sale with a few bids (3 hour flight, e.g. London-Rome)

500+ KgCO2 for more bids and more sales (5+ hour flight, NYC-LA)

Note that these figures are very similar to those calculated in the article below. This is because, (until very recently) digiconomist’s top-down estimates (which is what my calculations are based on) were very close to Kyle’s bottom-up estimates. It’s worth noting that very recently, digiconomist’s estimates have increased significantly higher than Kyle’s estimates. This is most likely due to the differences in the bottom-up and top-down approaches to handling events such as the rapid increases in the value of ETH leading to miners seeking to use older (and less efficient) GPUs, and the banning of mining in China causing miners to relocate to other countries (such as mostly coal-powered Kazakhstan). In reality, most likely digiconomist is now over-estimating, while Kyle is most likely under-estimating. This means that it’s very probable that the current true figures are considerably higher than those mentioned in this article.

Updates

- 23.01.2021 Anonymized all data. For verification purposes only, details available upon request

- 10.02.2021 Moved some footnotes (e.g. ETH2) to main body

- 26.02.2021 A much shorter summary of this article has been published in the online publication Flash Art under the title “Toward a New Ecology of Crypto Art: A Hybrid Manifesto”

This post has attracted a lot of criticism for being too “one-sided”. This is absolutely true, it is intentionally so. The reason for this is that there are already hundreds of articles covering many other aspects of NFTs or CryptoArt, but not a single article or study looking at it from an ecological perspective. My mistake was that I did not make it clear from the beginning that this was my position. So now I’d like to make it very clear that what follows is not a general “all-sides-of-the-story” article, but focuses only on the CryptoArt / NFT Market from one perspective, which I believe has to be — but yet has not been — included as part of the conversation. Please refer to other articles for a broader picture regarding NFTs or CryptoArt.

There is of course a larger discussion around the ecological impact of PoW blockchains in general (e.g. Bitcoin, Ethereum). This ‘discussion’ is severely polarized between the pro-crypto who believe “mining is mostly green and without a doubt a net-positive for the climate and the world”, vs anti-(PoW) crypto who believe it to be a waste of resources. For a reasonable pro (Bitcoin) position please see [43], and a reasonable anti (PoW) position please see [60].

I hope that this article starts a productive conversation, and we do not readily jump on and accept the new commercial platforms handed to us by Silicon Valley-style move-fast-break-things accelerationism, and instead we strive for better, built on the values that we hope to carry into the future.

Introduction

This is Part 1 of a N-part series, accompanying the website http://cryptoart.wtf

Part 0 (26th Feb): A short summary of this article has been published in the online publication Flash Art under the title “Toward a New Ecology of Crypto Art: A Hybrid Manifesto”. I suggest this as a starting point.

Part 1 (this article): I present my motivations, findings, and my conclusions as a result of these findings.

Part 2: I present the underlying data and methodology that gave rise to these findings, along with more statistics. It’s more aimed at those who wish to dig deeper into the numbers, and/or technically interrogate my claims.

Part 3 (25th Feb): I —with contributions from many others — have put together some information with regards to more sustainable NFTs.

What is this? What’s going on?

The website http://cryptoart.wtf estimates the carbon footprint of CryptoArt NFTs as a result of blockchain (specifically Proof-of-Work, Ethereum) based transactions relating to the NFT. These figures do not include the production or storage of the works, the computers directly engaging in the act (e.g. the seller or buyers’ computers), or even the website itself, but is simply for the act of using the PoW Ethereum blockchain to keep track of sales and activity.

What? Why?

CryptoArt — using the blockchain to track sales and bids of (mostly digital) artworks — is booming.

Many people (myself included, until I started this investigation) are seemingly unaware how ludicrously energy consuming and ecologically destructive some blockchain based activities are — orders of magnitude worse when compared to other activities typically carried out by individuals.

Bitcoin, Ethereum, and some other cryptocurrencies use a consensus algorithm known as Proof-of-Work (PoW)¹ ². This allows information to be stored in a distributed, decentralized manner across many nodes in a network (e.g. The Internet), while remaining secure, reliable and dispute-free. (There are alternatives to PoW which are far more efficient, but PoW is currently the most widely used ¹).

Ingeniously idiotic, by design² the PoW algorithm is very compute intensive [1, 2, 3, 40]. The original cryptocurrency Bitcoin (BTC), is estimated to have annual energy consumption in the range 80–120 TWh [3, 40] which is about ~0.45% of the world’s entire electricity production.

In this article however, I will not focus on Bitcoin, but Ethereum.

Due to its ability to execute custom code in a decentralized manner via ‘smart-contracts’, Ethereum is currently a very popular blockchain in the world of CryptoArt, and more generally speaking, Non-Fungible Tokens (NFT).

NFTs are custom tokens that can be created (i.e. ‘minted’) on the blockchain, and then traded. NFTs can be minted as unique one-offs, or they can be limited edition runs (e.g. of a few dozen, hundreds, or thousands). And linking NFTs to other assets (physical or digital), seemingly introduces a scarcity to those assets that might otherwise be unattainable.

This alleged scarcity, combined with the speculative crypto-hype-bubble-startup-craze — has fueled the CryptoArt market, as well as a booming general NFT Rare Collectibles market [5].

After a slow but steady growth over the last few years, this year — perhaps accelerated by Covid19 — CryptoArt has exploded, with artists from many generations announcing their soon-to-be first NFT drop [6].

Truth be told, I am incredibly excited by the idea of purely digital platforms generating sustainable income for digital artists. This is why I started investigating a few months ago. I knew that Proof-of-Work blockchains were “bad for the environment”, but it turns out there is absolutely no information whatsoever regarding how this translates to NFTs as they are currently implemented. Hence I started this research.

When I began sharing this information in September 2020, it was mostly ignored, but at least one cryptoartist — Joanie Lemercier — became concerned and spent several months trying to get more information from the platform he was working with. In his own words: “Joanie Lemercier tried to have this conversation with NiftyGateway for months, to understand the impact of his release, but couldn’t get any information about this. He only got the classic Silicon Valley response: ‘we will check with the team and get back to you’. Lemercier is trying hard to reduce his studio’s electricity consumption every year, and it turns out his NG release consumed in 10 seconds more than his entire studio over one and a half years”.

This lack of transparency is unacceptable. Providing even ball-park figures, or simple advice regarding ecological impact should be compulsory. It was clear a more radical approach was needed to get people’s attention, to start talking about this, so I wrote this article and made the website cryptoart.wtf.

I was also approached by another cryptoartist asking about their footprint. They were horrified to hear it was in order of a hundred tonnes of CO2. (To put this into perspective, across Europe and the US the annual per capita carbon footprint of all industry, trade, and imported goods is on the order of ten tons of CO2 [42]).

The problem: the ecological cost

While not as bad as Bitcoin, a single Ethereum (ETH) transaction is estimated to have a footprint on average of around 35 kWh [4].

This in itself, is ludicrously high. To put that into perspective, this is roughly equivalent to an EU resident’s electric power consumption for 4 days [8].

And this is for simply a single ETH transaction. This is for an act which takes a fraction of a second from the point of view of the person engaging in the act. A single click of a mouse sets off a chain reaction and sends a signal to mining farms around the world [11, 12], which go on to have a footprint of 35 kWh for an ‘average’ transaction (details in Part 2), with emissions of close to 20 KgCO2 for that single mouse click³, due to the underlying PoW algorithm. (Whereas for example, an average email is estimated to have a footprint of a few grams of CO2 [33], and watching one hour of Netflix is estimated at around 36 grams CO2 [22]. An ETH transaction is thousands times more costly than other internet activities that individuals typically engage in).

And this is an average ETH transaction. Unfortunately, it turns out that NFT sales and related transactions on a PoW blockchain such as Ethereum, are a lot worse.

Depending on the complexity of its requirements, an ETH transaction might have a higher or lower footprint (details in Part 2). 35 kWh might be the average across all transactions that are happening on the ETH network, many of which consist of a simple value exchange. Transactions relating to NFTs however, have more complexities involved.

In fact, I have analyzed ~80000 transactions relating to ~18000 NFTs on the CryptoArt NFT market site SuperRare (which is just one of many CryptoArt NFT platforms).

The footprint of a single transaction relating to a NFT on SuperRare averaged across all 80000 transactions (including minting, bidding, sales, transfers etc) is 82 kWh, with emissions of 48 KgCO2 (details in Part 2).

Note that this is more than double that of an average ETH transaction.

Unfortunately, it gets worse.

A single NFT can involve many transactions. These include minting, bidding, cancelling, sales and transfer of ownership. If we were to break down the footprint by transaction type, we get (details in Part 2):

Minting: 142 kWh, 83 KgCO2

Bids: 41 kWh, 24 KgCO2

Cancel Bid: 12 kWh, 7 KgCO2

Sale: 87 kWh, 51 KgCO2

Transfer of ownership: 52 kWh, 30 KgCO2

This generally pushes the footprint of a single NFT into hundreds of kWh, and hundreds of KgCO2 emissions, and often higher.

In fact, of the ~18000 CryptoArt NFTs that I analyzed, the average NFT has a footprint of around 340 kWh, 211 KgCO2 (details in Part 2).

This single NFT’s footprint is equivalent to a EU resident’s total electric power consumption for more than a month, with emissions equivalent to driving for 1000Km, or flying for 2 hours.

And I would like to again point out, that this energy consumption is simply for the act of using a Proof-of-Work (PoW) based blockchain — that was designed deliberately² to be so compute intensive— to keep track of bids and sales. It excludes the energy consumption of the actual production of the work. It excludes the energy consumption related to storing the work online. It excludes the energy consumption of the website itself, or the computers of those involved in minting, bidding or selling.

Accumulating a few of these NFTs easily pushes the footprint into MWh, with tonnes of CO2 emissions.

2 out of 3 (67%) of the 633 artists on SuperRare have NFTs with a footprint of more than 1 tonne CO2. And this is despite half of the artists joining the platform in only the last 6 months.

1 in 5 (18%) of the artists’ NFTs have a footprint greater than 10 tonnes of CO2. To put that into perspective, that is equivalent to 12 transatlantic flights, or a EU resident’s total electric power consumption for 5 years.

The average footprint of an artist’s NFTs on SuperRare is 10 MWh, 6 tCO2 while the median is 3 MWh, 2 tCO2. (The average time an artist has been on SuperRare is 11 months, the median is 7 months. Details in Part 2).

The footprint from all NFTs on SuperRare is 6 GWh, 3.8 Mt CO2.

(This is just for keeping tracking of bids and sales remember, this excludes the hosting of the actual website, the production of the work, the artists’ computers, the buyers computers etc).

Unfortunately, it gets worse.

The above is based on an extensive analysis that I’ve carried out over the past few months on the CryptoArt NFT marketplace website SuperRare. SuperRare — as the name might imply — deals with one-off NFTs. However, other NFT websites allow editions.

Editions are a way that allows creators to get more ‘bang’ for their buck. Quite literally — as they can sell the same work more than once, and that ‘bang’ carries out into the environment, as 10x, 100x more tonnes of CO2.

NiftyGateway is another NFT marketplace site on the PoW blockchain Ethereum. Unlike SuperRare, NiftyGateway does not track all activity on the blockchain. They mint on the blockchain, and then track bids and sales on their own servers. Unfortunately, minting is the most ecologically expensive action, 3–4 times more costly than bidding for example (details in Part 2). For this reason, the PoW blockchain related eco-costs are still very high— especially when combined with editions.

One artist for example, released a handful of artworks, each editioned in the hundreds, totaling over 800 editions. In less than 3 months, thanks to the PoW algorithm used by the Ethereum blockchain, these 800+ editions collectively have a footprint in order of 140 MWh with 86 tonnes of CO2 emissions, equivalent to a EU resident’s total electric power consumption for 40 years, with carbon emissions equal to 100+ transatlantic flights.

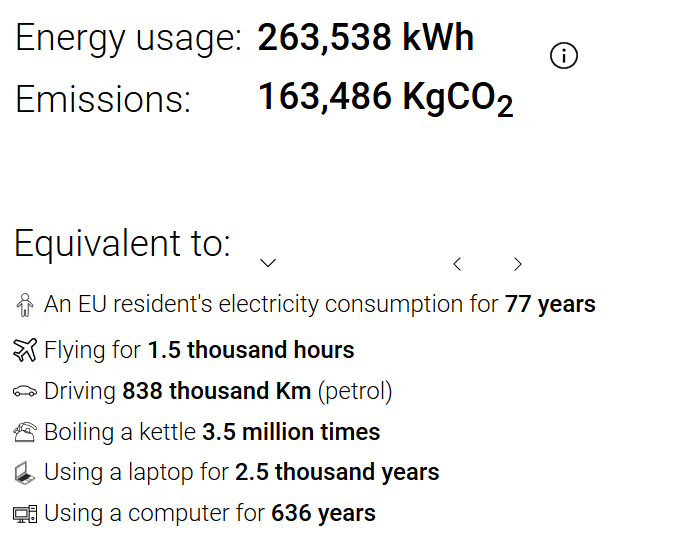

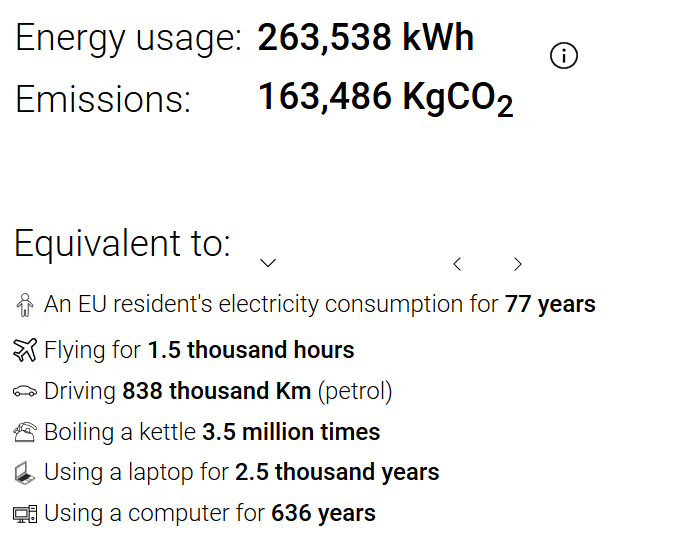

Another artist who has been on the platform slightly longer, has created dozens of NFTs with over 1500 editions in total. In under half a year, thanks to the PoW algorithm, these NFTs have a footprint in order of 260 MWh with 160 tonnes of CO2. That’s a quarter of a GWh, in under half a year.

It’s also important to remember, that the amount an NFT is sold for, i.e. it’s financial cost, does not affect its ecological cost. A transaction’s carbon footprint will be the same whether it sells for one dollar, or a million dollars (details in Part 2).

An incredibly painful to observe strategy that I’m routinely witnessing, is to price NFTs really cheap (e.g. in the 10s of $ range) and edition them in the many hundreds.

For example, one NFT (not by one of the above artists) was priced in the range of 10s of $ per edition, with many hundreds of editions. In 2 months, this single artwork has a footprint of approximately 74 MWh, with 46 tonnes of CO2 — equivalent to a EU resident’s total electric power consumption for 22 years , or the carbon emissions of over 50 transatlantic flights — in 2 months.

At this point I should be very clear that I am absolutely not blaming the artists. I have no doubt in my mind that they have no clue this is happening. There is no information out there regarding this. I’ve had to spend months to dig out and put this information together. And that is the aim of this article — to make it clear that this is happening.

Final thoughts

In this article, I focused on CryptoArt, because as a computational artist this is a topic that is dominating my spheres right now. However, all of what I say above, applies not just to CryptoArt, but PoW based NFTs in general (in fact most of it applies to PoW cryptocurrencies in general).

And interest in NFTs is growing rapidly, to the extent that the trend now is to NFT everything. Tokenizing and selling screenshots of tweets on the blockchain is a thing [28].

I want to express caution once again, against pointing to the artists. They are not the problem. I believe they have no idea that this is happening. The community that has emerged around CryptoArt is absolutely more supportive of digital arts in comparison to previous markets. By this, I am very encouraged and hopeful.

And I would love to see this community move to more sustainable platforms which do not have footprints of MWhs — even 100s of MWhs when editioned — per artwork.

Artists should be able to release 100s of digital artworks. There is absolutely no reason that releasing 100s of digital artworks should have footprints of 100s of MWh.

Right now there is absolutely zero information available with regards to the carbon footprint of NFTs. Today, one can look up the carbon footprint of flying, and then decide whether to fly or not. The same can be said of eating beef, or buying clothes. One can look up the carbon footprint of an email [33], or watching an hour of Netflix [22], and act accordingly. Are these figures accurate? Not necessarily. But if research says that an hour of Netflix is 36g, it’s unlikely to be in reality 10 tonnes. It might be 20g, 50g, 100g. Maybe even 200g. But not 10 tonnes. Such research is a start. I welcome others to look at my methodology, see the flaws, and put out new studies. And then we can make informed decisions.

Given the urgency of the current climate crisis, we are already faced with the immense challenge of having to change our existing habits. And changing habits which are deeply entrenched into every aspect of our lives and culture, and the systems that we depend upon, is really hard. Yet that’s what we must do. Given this, is it really wise to adopt new systems and habits that are as ecologically devastating as this?

To me it seems like lunacy.

When designing and developing new systems, platforms and habits, design and develop them compliant with the standards and expectations of the time!

130 kWh, 80 KgCO2 for a single mouse click to mint a single-edition NFT is ridiculous and unethical.

340 KWh, 210 KgCO2 just to record a handful of bids and sales on a single-edition NFT is outrageous and unethical.

100s of MWh, 100s of tonnes of CO2 in a few months, just to keep track of a few dozen editioned NFTs is absolutely deranged.

Of course even these figures — and anything an individual does — are a drop in the ocean of global emissions (~50 billion tonnes CO2e [44]). Of course we have to completely decarbonize our energy production (which must probably include nextgen nuclear [45]), and invent new, negative emission carbon capture and storage technologies [46]. But at best these are going to take decades to be invented, tested and deployed on a global scale. In the meantime, our emissions are not only not decreasing, they are increasing (excluding a small lockdown related decrease in 2020 [44]).

We need a radical shift in mindset.

Research into new technologies (including blockchain) is essential. But this has to follow a conscious, less extractivist model. I welcome the fundamental research happening in this space, but there is no doubt the recent rapid growth of the NFT market exemplifies Silicon Valley’s move-fast-break-things accelerationism. If this were not the case, more ethically aligned platforms might have included ecological statistics on their site, alongside sales and ROI statistics. They might have provided advice and caution regarding immense ecological impact. As Christina Akopova, cofounder of cryptoart platform Pixeos — which is not on Ethereum, but on the DPoS based EOS blockchain — notes “If you don’t buy the #cryptoart you like cause it’s not on ETH, you are basically an ETH tokens collector, not an art supporter.” [47]

If profit is going to be the primary motivation for this growth and research, then one of our strategies must be to make it more profitable for businesses to act more responsibly. Unfortunately, this kind of social pressure remains essential for corporate social responsibility [48, 49]. Reducing one’s own emissions is not just about reducing one’s own emissions. It also sends a signal to the market demonstrating that there is a demand for more sustainable and transparent businesses, and gives confidence to investors, developers and collectors to invest accordingly [61].

Alternatives to PoW have been deployed or in the works for many years [26, 35, 36, 50, 51, 52, 53, 54, 55, 56, 57]. In fact, as I write this, Ethereum has just launched a test network for ETH2 aka Serenity using a Proof-of-Stake (PoS) consensus algorithm [27] which is orders of magnitude more computationally efficient (this is also essential for scalability and business, as we are already seeing skyrocketing Gas prices). While there is no clear date for when ETH2 will be rolled out for mainstream use, the best case estimate is that it will be in the next year or two. While this will (hopefully) resolve the energy problem, it does not address the larger issue. Given the constraints imposed upon us by Global Warming — we have a severe problem if we cannot discuss the issues of today because we hope they will be resolved “in a year or two”, and if we obliviously allow and even encourage businesses and platforms to operate in this manner. Because if we don’t hold businesses and markets accountable, as artists, and as citizens, then who will?

I’ve been working on this project — the underlying research, the data analysis, and the website http://cryptoart.wtf ⁵— for months. I have seen probably thousands of CryptoArt NFTs. I’m blown away by how much absolutely awesome work there is on here. Much of this work does not fit into the typical, established Art Venues. These artists and works absolutely need a home, and digital artists absolutely should be able to earn a living making work that they love.

If we are building new systems, we should build them aligned with the values that we hope to carry into the future. I hope that this article can start a conversation and we can avoid the move-fast-break-things accelerationist mistakes of the past, and instead plan our way forward in a sustainable manner.

Additional notes

These figures are calculated from blockchain data and existing research (see Part 2 for details). Are they “accurate”? They are as accurate as they can be based on the current data and research, which does have many unknowns. Furthermore, the true figures are continually changing. In that respect these figures are best thought of as representing the true scale (e.g. hundreds of Kg C02, tonnes of CO2, tens of tonnes of CO2 etc. i.e. orders of magnitude). The accuracy also depends on the acceptable error margin. One of the most authoritative critiques of the method used by [4] comes from Jonathan Koomey [62], who finds the model too “simplistic”. For an analyst who works with clients where lives are literally at stake if errors are made [63], this is completely understandable. For the purposes of our discussion however, even if the true carbon footprint of a multi-edition NFT is 50 tonnes CO2 instead of 100 tonnes, it really should not affect this conversation — as it is not going to be in reality, 50 grams, or even 50 Kg. Furthermore, the “Bevand” method — which is recommended by Koomey — is used by [39] to estimate the energy consumption of Bitcoin, and is currently producing 40% higher estimates than the method used by [3, 4], rendering it unlikely that the Ethereum estimates will be significantly (e.g. an order of magnitude) over-estimating.

There is a common fallacy along the lines of “The same energy will be consumed whether a block is empty or contains your transaction, thus a transaction has no impact on the energy consumption of a block being mined, or on the environment”. This is based on a gross misunderstanding of what a carbon footprint is (see Part 2 for details). This statement is analogous to claiming “when a 500 tonne airplane flies from NYC to LA, it consumes the same amount of fuel whether I ride it or not (because the weight of a person is negligible compared to the weight of the plane). Thus my flying has no impact on the environment”. It is true that one person deciding to fly (or not) does not have an immediate effect on emissions. However, there is a footprint associated with a seat on a plane. Furthermore, the market demand for flying, affects how the aviation industry schedules flights. In fact, if all of a sudden, lots more people wanted to fly, the aviation industry would not be able to all of a sudden schedule more flights overnight. However, the mining industry can respond much quicker to increases in demand, compared to the aviation industry. Miners even usually have older mining equipment which are no longer profitable to mine with (i.e. the electricity costs of running the equipment is greater than the financial rewards). But if demand goes up on the network, transaction fees also go up, and mining becomes more profitable to the extent that miners can respond quite quickly by turning on such older equipment [41]. More detail on calculating the footprint of individual transactions can be found in [67].

Mining is not primarily powered by renewables. One report produced by a crypto-investment agency [64] claims that (Bitcoin) mining is 75% powered by renewables. However, other independent (and arguably more thorough, as they include more regions and the changing seasons and miner migration) studies put the figure much lower at 29%–39% [41]. The data that I use to calculate emissions, includes usage of low-carbon energy sources weighted by hashrate of regions, with a global weighted average of ~40% low-carbon energy production (0.58 KgCO2/kWh) — inline with this research. This is based on data from [66, 67], and the limitations of the accuracy of this approach is detailed in those links. (On a side note, using renewables is not a solution if it displaces others from using that renewable source [65]).

Mining is not primarily powered by surplus hydro-electric power in China. Emphasis mine: “There is a notion that electricity surplus in some APAC areas, such as the province of Sichuan in China, gives hashers who relocate their operations there during the rainy season [May-Oct/Nov] a competitive advantage in minimising their running costs. However, survey data demonstrates that this seasonal advantage appears to be offset by less affordable electricity prices throughout the rest of the year when hashers migrate back to other provinces, such as Xinjiang or Inner Mongolia in China. […] Coal-based mining is principally adopted in regions such as the Chinese provinces of Xinjiang and Inner Mongolia, and in Kazakhstan, whereas hydroelectric energy is mainly generated in South-Western regions of China (Sichuan and Yunnan). China’s oversupply of hydroelectric energy during the rainy season has often been used as evidence in claims that a vast majority of mining is powered by environment-friendly power sources. While it is true that the Chinese government’s strategy to ensure energy self-sufficiency has led to the development of massive hydropower capacity, the same strategy has driven public investments in the construction of large-scale coal mines. Like hydroelectric power plants, these coal power plants often generate surpluses. It should not come as a surprise then that a significant share of hashers in the region equally report using both hydropower and coal energy to power their operations”. p24, p27 [41].

Acknowledgements

Thank you to everybody on this twitter thread and this twitter thread for the feedback and help. Even the negative comments were very helpful. And a special thanks to Hanna Radek, Primavera De Filippi, Kyle McDonald, Joanie Lemercier and Alan Warburton for feedback, thoughts, help with the design and general guidance.

Stay safe y’all.

Footnotes

- (Info on ETH2 moved to main body under “Final Thoughts”)

- Proof-of-Work (PoW) is designed to be computationally inefficient. Its security comes from the fact that it requires so much computation to write to the blockchain (i.e. add ‘blocks’). The logic is essentially: if it’s stupendously compute-heavy and difficult to write to the blockchain, then it can’t be done frequently enough to pose a security threat. You might see articles refer to this task as ‘solving a mathematical puzzle’. This is a vast romanticization. In reality, to write to a PoW blockchain (and reap a reward of the associated cryptocurrency, e.g. BTC or ETH etc.), one has to generate a random number and hope that it matches the criteria set by the protocol. If it doesn’t match, generate another random number. For this reason, endless arrays of computers are sitting around in giant data-center like mining farms around the world, doing nothing but generating random numbers all day every day, in the hopes of rewarding their owners with reaping the rewards [11, 12, 13]. Furthermore, as more people (or more compute power) get involved, the more likely it is statistically for somebody to stumble upon a random number that satisfies the criteria — and thus quicker. This could compromise the security of the network, so the protocol dynamically adjusts the criteria to become more difficult such that new blocks are always written at roughly a fixed frequency (every ~10 minutes for Bitcoin,~10–20 seconds for Ethereum). As a result, as more people (or computer power) get involved with a PoW blockchain, the more difficult it must become in order to remain secure. In ~10 years, since the introduction of BTC in 2009, its difficulty has increased 18 trillion times. That’s 18000000000000 times [18].

- A similar argument could be made for using the Internet in general. In that, every email that we send, every tweet that we tweet, sets off a chain reaction involving routers and servers and data-centers around the world. The Internet definitely does consume a lot of energy, estimated to be in order of 200 TWh/year just for the data-centers [21]. This is primarily due to the immense volume of activity taking place on the Internet. When looked at from a per transaction point of view, blockchain based activities are ludicrously many many many orders of magnitude higher than other online activities. For example, an average email is thought to have emissions of around 1–10 gCO2 [33] (though now it’s thought to be lower). That’s 40000 times lower than an average single-edition NFT. Watching an hour of Netflix is estimated to be around 36 gCO2 [22]. That’s 6000 times lower than an average single-edition NFT.

- (moved to main body)

- http://cryptoart.wtf only reads from the blockchain (e.g. “Who bought this NFT?” etc.), so it does not incur the ludicrous eco-costs that I discuss in this article. Mining (i.e. writing to the blockchain) is the procedure that is so compute intensive² (e.g. “X created a new NFT”, “Y placed a bid on this NFT”, “Z bought this NFT ” etc.).

- (moved to main body)

- (moved to main body)

References

- https://www.sciencedirect.com/science/article/pii/S2542435118301776

- https://www.sciencedirect.com/science/article/pii/S2542435119302557

- https://digiconomist.net/bitcoin-energy-consumption

- https://digiconomist.net/ethereum-energy-consumption

- https://cryptoticker.io/en/top-5-nft-marketplaces/

- https://twitter.com/search?q=nft%20drop&f=live

- https://www.eea.europa.eu/signals/signals-2017/infographics/range-of-life-cycle-co2/view

- https://data.worldbank.org/indicator/EG.USE.ELEC.KH.PC

- https://www.cbc.ca/radio/ideas/the-1989-cbc-massey-lectures-the-real-world-of-technology-1.2946845

- MASSIVE Crypto Mining Farm Tour | Bitcoin, Dash, and GPU Mining! https://www.youtube.com/watch?v=4ekOcDG2D8E

- Visiting the LARGEST BITCOIN mining FARMS in CHINA https://www.youtube.com/watch?v=NrLENhrTrMA

- https://www.forbes.com/sites/ktorpey/2019/07/28/bitcoin-mining-centralization-is-quite-alarming-but-a-solution-is-in-the-works/?sh=24fdad03530b

- https://www.investopedia.com/investing/why-centralized-crypto-mining-growing-problem/

- https://lokinetwork.medium.com/the-problem-with-asics-3c9cee44f383

- https://www.bloomberg.com/news/articles/2020-11-06/winklevoss-twins-ride-bitcoin-surge-to-become-billionaires-again

- https://www.investopedia.com/news/winklevoss-twins-are-bitcoins-first-billionaires/

- https://www.blockchain.com/charts/difficulty

- https://visuall.net/2012/07/07/a-tool-to-deceive-and-slaughter-by-caleb-larsen/

- https://twitter.com/satman78704554/status/1339912522514780163

- https://energyinnovation.org/2020/03/17/how-much-energy-do-data-centers-really-use/

- https://www.carbonbrief.org/factcheck-what-is-the-carbon-footprint-of-streaming-video-on-netflix?

- https://plato.stanford.edu/entries/game-theory/

- https://cbeci.org/mining_map

- https://www.washingtonpost.com/news/wonk/wp/2013/09/26/wonkabroad/?arc404=true

- https://spectrum.ieee.org/computing/networks/ethereum-plans-to-cut-its-absurd-energy-consumption-by-99-percent

- https://eth.wiki/concepts/proof-of-stake-faqs

- https://twitter.com/Cent/status/1341702668868186112

- https://www.crunchbase.com/organization/opensea/company_financials

- https://www.crowdfundinsider.com/2020/12/170494-ethereum-based-nfts-axie-infinity-sorare-and-superrare-record-over-1-million-in-trading-volume-in-past-month-report/

- https://etherscan.io/tokens-nft

- https://calculator.carbonfootprint.com

- https://carbonliteracy.com/the-carbon-cost-of-an-email/

- https://edition.cnn.com/2020/10/06/health/flu-covid-19-deaths-comparison-trnd/index.html

- https://blog.ethereum.org/2014/11/25/proof-stake-learned-love-weak-subjectivity/

- https://blog.ethereum.org/2015/03/03/ethereum-launch-process/

- https://ethereum.org/en/eth2/vision/

- https://ethereum.org/en/eth2/#roadmap

- https://cointelegraph.com/news/ethereum-2-0-s-long-and-winding-road-to-scalability-launch

- https://www.cbeci.org/

- https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/3rd-global-cryptoasset-benchmarking-study

- https://cbeci.org/mining_map

- https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions#co2-embedded-in-trade

- https://netpositive.money/faq

- https://www.globalcarbonproject.org/carbonbudget/

- http://withouthotair.com/

- https://www.iea.org/commentaries/going-carbon-negative-what-are-the-technology-options

- https://twitter.com/Artkopova/status/1318883097543364609

- https://www.gsb.stanford.edu/insights/social-pressures-affect-corporate-strategy-performance

- https://www.annualreviews.org/doi/abs/10.1146/annurev.soc.012809.102606

- https://eos.io/

- https://polkadot.network/

- https://cardano.org/

- https://near.org/

- https://www.onflow.org/

- https://solana.com/

- https://www.avalabs.org/

- https://www.regen.network/

- https://ethereum.org/en/developers/docs/layer-2-scaling/

- https://www.immutable.com/#exchange

- https://www.ofnumbers.com/2021/02/14/bitcoin-and-other-pow-coins-are-an-esg-nightmare/

- https://www.penguinrandomhouse.com/books/633968/how-to-avoid-a-climate-disaster-by-bill-gates/

- https://www.coincenter.org/estimating-bitcoin-electricity-use-a-beginners-guide/

- https://eta-publications.lbl.gov/sites/default/files/lbnl-1005775_v2.pdf

- https://coinshares.com/research/bitcoin-mining-network-december-2019

- https://www.wired.com/story/bitcoins-climate-impact-global-cures-local/

- https://www.notion.so/Carbon-FYI-Methodology-51e2d8c41d1c4963970a143b8629f5f9

- https://carbon.fyi/learn

Attributions

The icons on the website are licensed under a Creative Commons license from The Noun Project: Car by ✦ Shmidt Sergey ✦, House by Liyuza Anizar Habiby, Kettle by Cuby Design, Swimming by SBTS, Laptop by Simon Child, PC by Jugalbandi, Face by BomSymbols, landscape by ProSymbols, texting by ProSymbols, Artificial Intelligence by Symbolon, Server by Iga, Gear by priyanka, greenhouse gas by Wichai Wi, Energy by Larea, Video by icons, person by Valerie Lamm, Arrow Direction Down by Gunali Rezqi Mauludi, Math by Llisole, link by Peter Carleton, text by ProSymbols, Info by NAS.